VateepTylimited was established in 2017. It claims to be the world's top difference contract broker. In 2019, it was named the world's top ten most potential difference contract brokers.The company provides six major trading products: foreign exchange, precious metals, commodities, cryptocurrencies, stocks, and indexes. They are always committed to creating the highest quality trading environment in the industry, which has received high evaluation of customers and has achieved the company's rapid development.

But its platform is really the most promoted on the official website of the most potential difference contract broker?IntersectionLet me take a look today. First of all, let's check the supervision qualifications of its platform ~

▶ VateepTylimited regulatory and email IP address inconsistency triggers guess

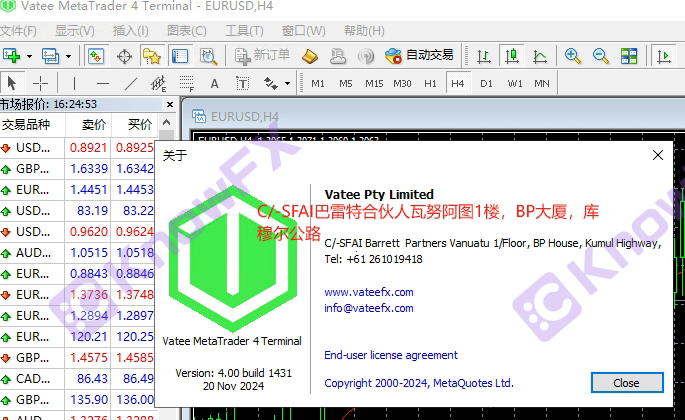

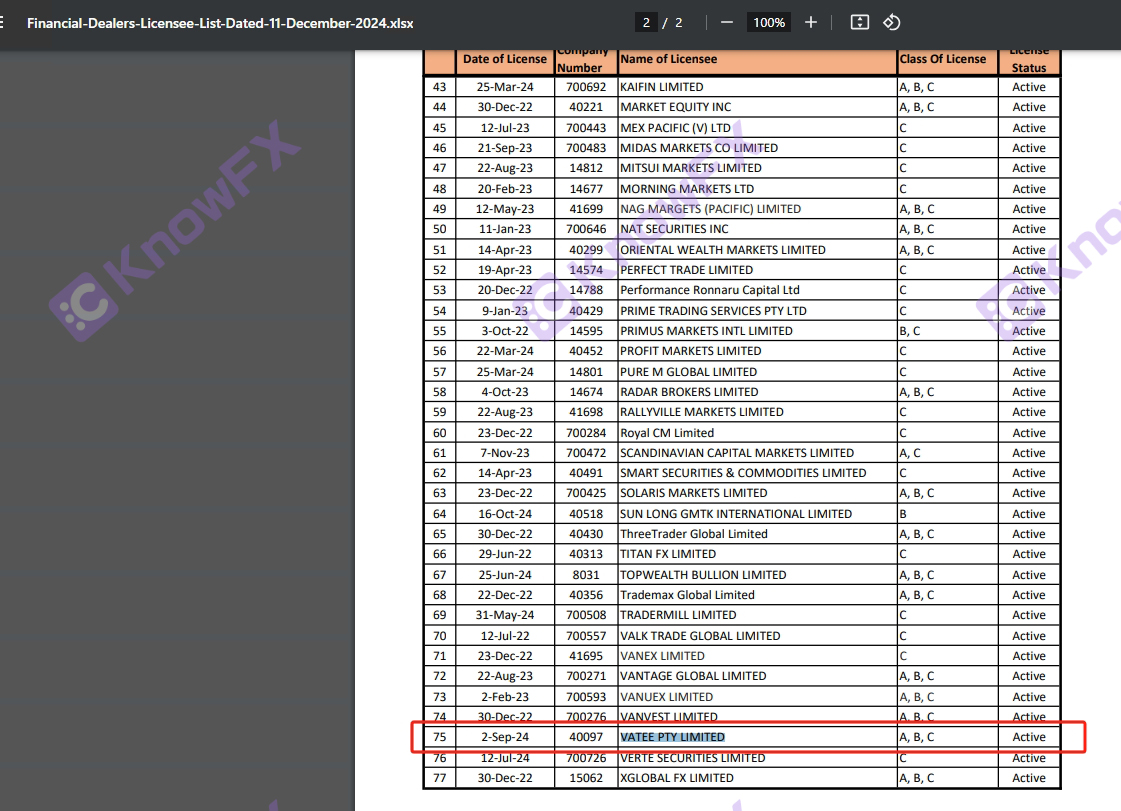

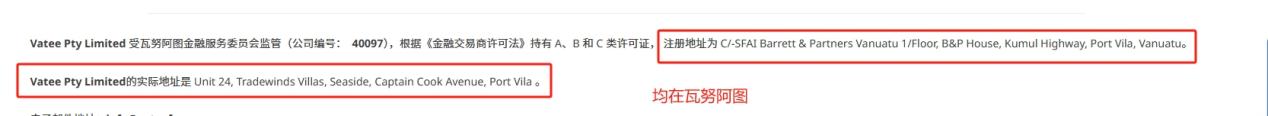

As shown in the figure above, Vatee only introduced one of the VATEEPTYLIMITED regulations on the official website of its official website (Company Number: 40097), which holds Class A, B, and C permits in accordance with the "Financial Traders License Law".

Through further verification surveys, we found that VateepTylimited has indeed regulated by the Vanuatu Financial Service Committee (VFSC).

Although VateepTylimited clearly stated on the official website that it was regulated by Wanuatu, it was surprising that the IP address of the market hotspot and risk incident notification with Wanteng Securities was displayed as Beijing, China.

This discovery is contrary to conventional cognition, because under normal circumstances, the email IP address used by foreign brokers should be consistent with the address of its country.

The actual address of VateepTylimited, a company introduced by Vatee's official website, is Unit24, Tradewindsvilla S, Seaside, CAPTAINCOOKAVENUE, Portvila (Unit of the Villa Grandma Shipper Trademark Villa No. 24) All.

VateepTylimited's trading entity is located in Vanuatu, but the email is issued from Beijing. This inconsistency triggered us to speculate whether Vatee has a branch or a partner in China.

Although this speculation has not been officially confirmed, it undoubtedly increases the complexity of the Vatee operating model and has made us more curious about its global business layout.

Although VateepTylimited has legal regulatory qualifications in Vanuatu, the inconsistency of the mail IP address reveals more details behind its operating model.

▶ User feedback Wanteng platform trading failure, Vatee platform services have been questioned

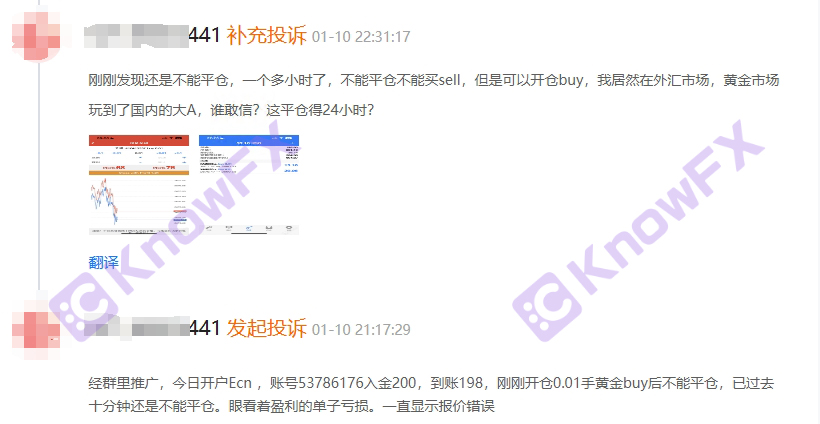

Recently, we are paying attention to a user feedback saying that after the promotion of the group, the ECN account is opened on the Wanteng platform.

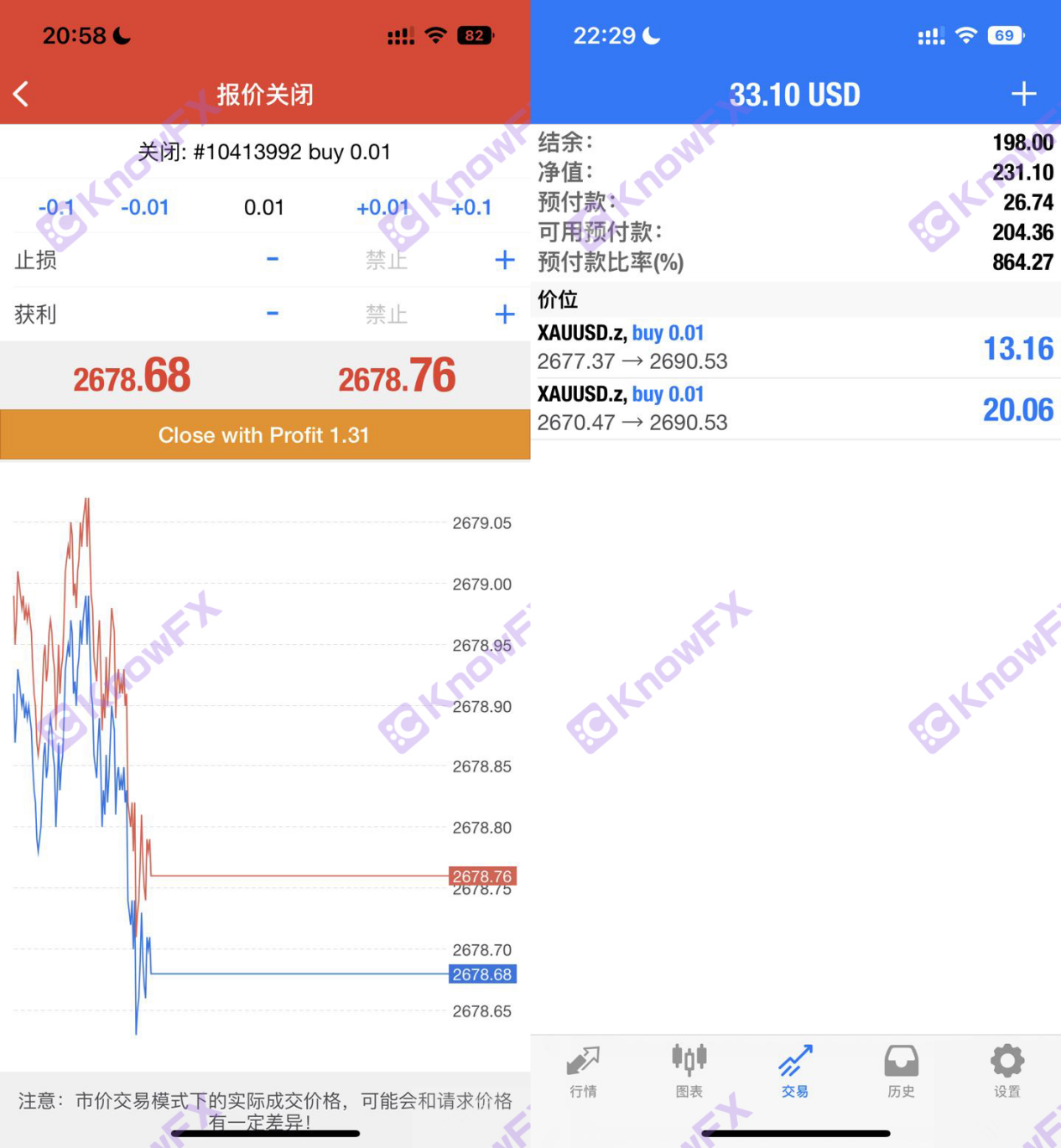

(The account is 53786176), and 200U funds (the actual account amount is 198U).Subsequently, I tried to buy a 0.01 -handed gold to buy a transaction. However, after the transaction started, I encountered the problem of unable to close the position.After the transaction has passed ten minutes, it is still impossible to close the position, and the original profitable transaction bill has also turned into a loss state.

During this period, the system has always showed a quotation error.In short, the user said that during the transaction of the platform, he encountered serious problems: the amount of funds did not match the amount of accounts, and the system could not be closed after the transaction began.

Here we can see that the Vatee platform has obvious shortcomings in terms of technical support and system stability, which also aroused questions about its customer service, capital security and transaction transparency!Intersection

▶ Vatee platform Customer fund storage storm: mixed funds, lack of transparency and caused a crisis of trust

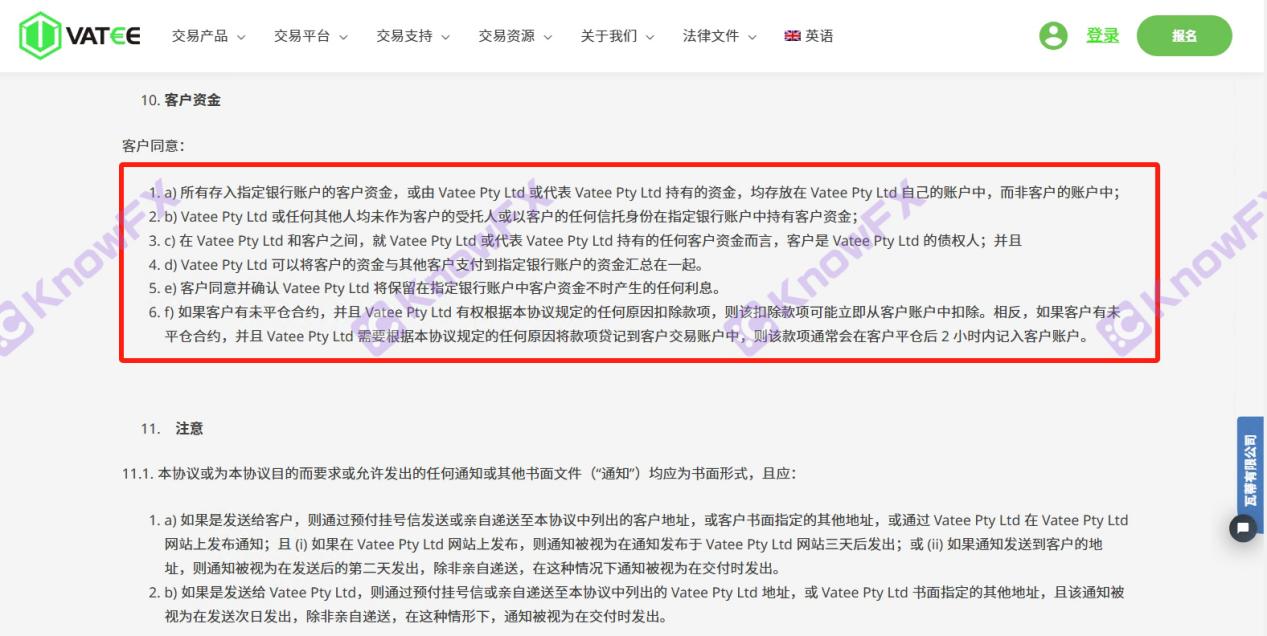

We see through the legal documents of the Vatee platform that its platform indicates that the terms and conditions of customer funds are somewhat inappropriate.

In normal financial practice, when customers deposit funds into the designated bank account, these funds should be stored in accounts opened in the name of customers, or at least in a special account that can clearly track and distinguish customer funds.

This can ensure that customers' funds will not be misappropriated by the company at will, and it is also convenient for customers to manage and supervise funds.

However, according to the customer consent information provided by the Vatee platform, VateepTyltd does not seem to follow this principle.

If VateepTyltd stores all customer funds in the company's own account, not the customer's account, this may cause the following problems:

1. Mixing risk: Customer funds and company operating funds are stored, which may cause the company to be unable to accurately track and distinguish which funds belong to customers and which funds belong to the company.This increases the risk of misuse or abuse of funds.

2. Transparency: Customers cannot directly view or supervise the use of their funds, which reduces the transparency of financial transactions.

3. Regulatory compliance risk: This approach may violate relevant financial regulatory regulations, leading the company to face legal risks and punishment.

4. Customer trust crisis: Once the customer finds that the funds are stored in the company's account, they may have a crisis of trust in the company and affect the company's reputation and business.Therefore, for VateepTyltd, it is a serious problem to store customer funds in the company's own account, and it is necessary to immediately take action to correct it.The company should communicate with customers as soon as possible, explain the situation and take remedial measures. For example, the customer's funds are transferred to an account opened in the name of the customer, and internal control and supervision are strengthened to ensure that similar problems will not occur.At the same time, the company should also actively cooperate with regulatory agencies to ensure that the business meets the requirements of relevant regulations.

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...