The ETORO architecture may have regulatory risks!He was punished by the Philippines SEC for 21 years or 5 million peso!

ETORO was founded in 2007, and it created a differently created investment community that focused on social cooperation and investor education.It is the fact that the broker of a platform.

However, it is not easy to provide "cross -asset investment"!Because countries have different recognition and tolerance for different assets. For example, my country has strict restrictions on foreign exchange and virtual currencies, which will correspond to the implementation of regulatory agencies and the distribution of licenses.

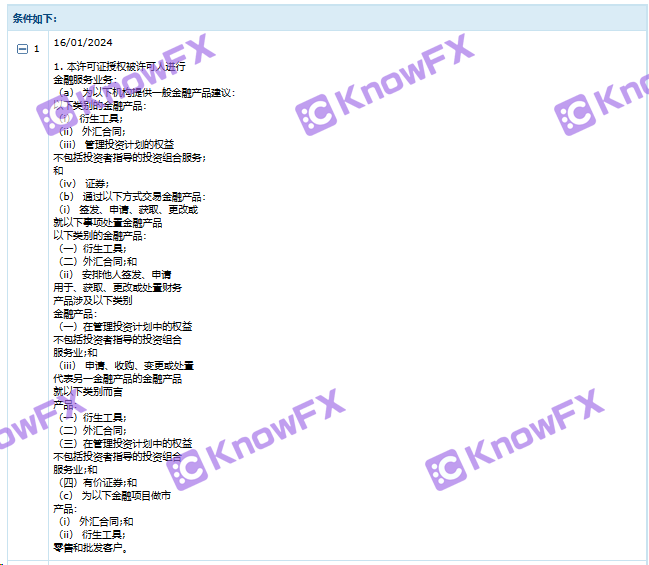

At the same time, it means that ETORO must meet the conditions for cross -asset investment services, and it must be operated in multiple countries. It can cover different asset investment by holding regulatory licenses with multiple countries!

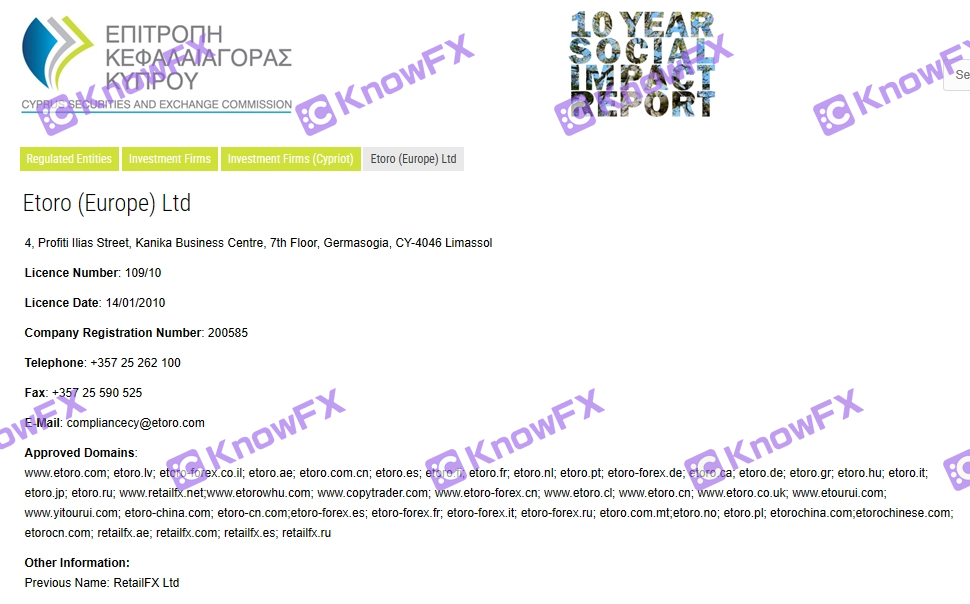

We can find through the ETORO official website that it does hold a lot of regulatory licenses!However, this also produces a lot of possible hidden risks, and it is also a test of investors' judgment on risk and regulatory compliance!

For example, Cysec, Cyez, is part of the EU regulatory framework. The service area obtained by the entity has obvious restrictions. Although there are Hong Kong and Taiwan, there is no mainland China!

In addition, the cryptocurrency market is not regulated under this framework, which means that ETORO's cryptocurrency transactions in Cyprus entities are not protected by supervision.

Like the securities regulatory license given by Seychelles FSA, similar regulatory problems will also occur.Therefore, it is not used in the cryptocurrency market!However, as a loose offshore supervision, it is often easy to become a gathering place for foreign exchange accounts for customers in various countries.

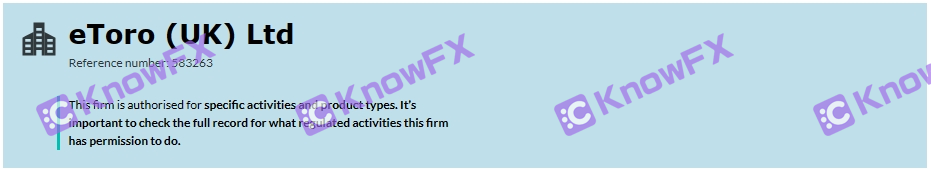

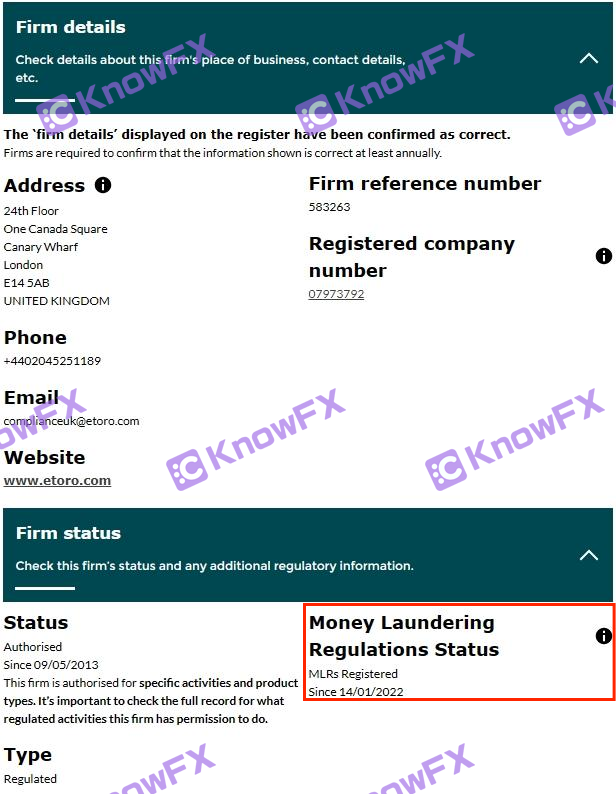

And the British FCA detective does not have to introduce too much.

However, it is worth noting that the British FCA that is separated from the EU system has obviously different characteristics that are different from other regulations. Especially for the cryptocurrency market, it is very advanced to have corresponding measures and supervision!

But Australia ASIC, which is also famous for strict supervision, is different, and it chooses a relatively conservative policy.

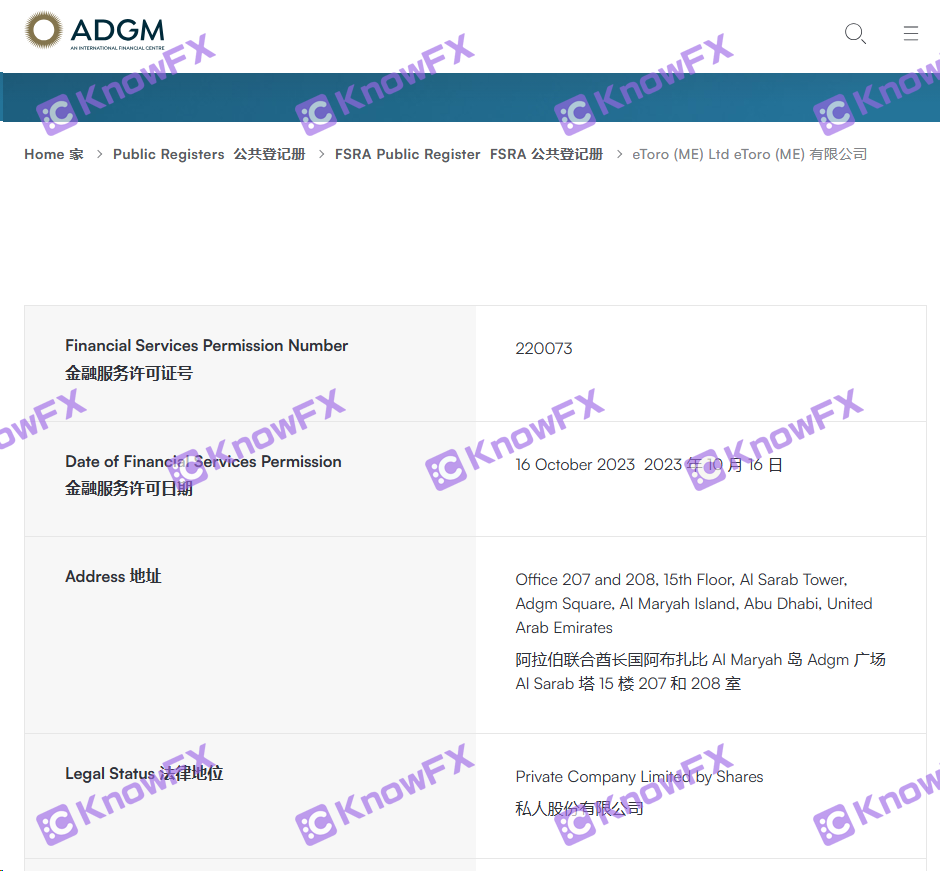

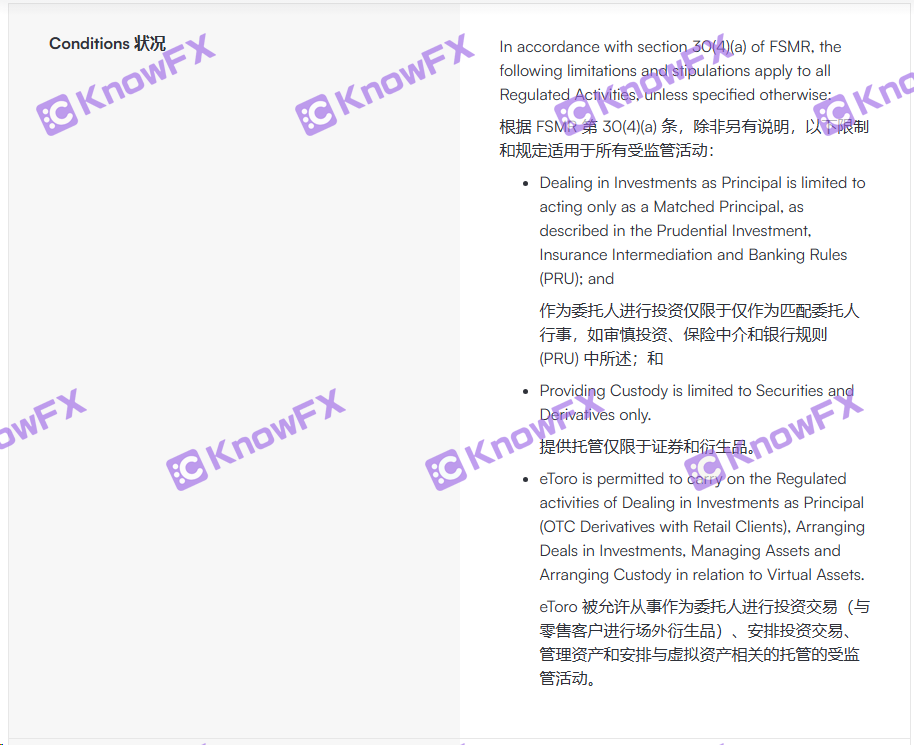

The same is true of the ADGM entity in the UAE's Abu Dhabi global market, but it is more conservative only limited to securities and derivatives!

This is just a superficial verification, there may be some leaks!

However, the probe expresses the possibility of "cross -asset investment" of ETORO's "cross -asset investment", but it does not mean that investors can freely invest and trade through ETORO!Investors still need to sign different agreements with different entities, in different regions, and conduct different transactions!

This means that the so -called "cross -asset investment" does not allow you to freely convert the type of assets, and essentially need to change the conversion of different entities.The difference between one is just that these conversion can be completed in the ETORO system.

But this complicated system will obviously interfere with investors and also provide convenience for many unscrupulous "agents"!It has also increased the cost and risk of investors' entry.

In particular, it only provides a self -developed trading platform to make the detective feel!

After all, its company's architecture and system are extremely complicated and dark, and there are many operating spaces.Today, only a self -developed trading platform is provided. Forgive God, it is impossible to believe in a dictator!

In particular, ETORO currently has a trend that is not controlled by fast expansion!This is not a recent warning of the Philippine Stock Exchange Commission SEC.

It is pointed out that the platform has not registered as a company in the Philippines, nor does it obtain a necessary license and authorization for sale or providing securities.Therefore, any individual or institution that promotes products in the Philippines may face a fine of up to 5 million peso or a maximum of 21 years of imprisonment.

Although ETORO is regulated and registered with financial regulatory agencies in many countries around the world, its business scope covers various assets such as stocks, cryptocurrencies, and differences in differential contracts, but its operation in the Philippines lacks corresponding legal support.ETORO itself denied its "active promotion" of its services in the Philippines and emphasized that it did not set up local business or marketing in the Philippines.

And this situation seems to be in line with ETORO's state, and it is necessary to invest in people to consider themselves.

If you need to check the platform, disclose clues, complain

Please scan the code to add a detective QQ!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP

Detective 1: 3464399446 Detective 2: 3147677259

Detective 3: 2124228721 Detective 4: 2389671330

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

近几年,货币行业越来越热,黑平台层出不穷,披着虚假金融衍生品的资金盘...

预告!泰国曼谷!FXEXPOAsia2024盛宴!启幕在即!2024...