The word leverage often appears in the exchange circle, or in other words, as long as investors really invest, they must choose leverage.In a straightforward point of view, leverage is to use the investment strategy of borrowing funds.Since leverage is the investment strategy of borrowing funds, of course, it is beneficial and disadvantaged.

The favorable side is that the greater the leverage, the less traders' margin, the more funds that can be used for transactions; secondly, the more positions that can be opened; the third is that the profit margin will be magnified.The profitable space is greater.

The disadvantage is that the ability to resist risks will decrease first, and the risk of explosion positions will also increase; secondly, while the profit margin is magnified, the loss rate will also be enlarged.

We must be clear that the higher the leverage, the more risks and returns are proportional.

Leverage is a double -edged sword.It can increase profitability, but also enlarge losses.Today, I will give you a look at some high -leverage problem platforms. Everyone must remember that water can carry boats and can cover the boat!IntersectionChoose a high leverage platform with caution!Intersection

1.FXBTG Banner Finance

FXBTG Banner Financial itself is a problem platform. Its main members have run from Shanghai to Malaysia in 2018!The FXBTG banner has been blacklisted by the Central Bank of Ireland and the Hong Kong Securities Regulatory Commission!

Its leverage is as high as 400 times!Intersection

2.GTC Zehui Capital

GTC Zehui Capital's official website tried to tout the spam software CTRADER. Everyone knows that trading orders that occur outside MT4/5 are difficult to protect.I want to remind everyone here, no matter how attractive the dealer writes the platform, please remember that it was developed by the dealer! All the right to interpret it is owned by GTC.Who dare not, who can't?What's more, this self -developed platform plus high leverage, BUFF is full!IntersectionIntersection

3.NCE

NCE is the black platform ANC that runs before!NCE itself has many guest complaints that they do not give gold. In addition, the platform's up to 1,000 times the leverage, advise everyone to run quickly!Intersection

4. RADEXMARKETS Redix

Radexmarkets is closely related to Gomarkets · Gaohui, while Gomarkets · Gaohui is a problem platform without effective supervision!IntersectionThe two licenses are mixed, confusing the audiovisual, and Radexmarkets Rydex's leverage is as high as 500 times!

5. Secretary Justmarket

This platform has no effective supervision. For details, you can view it on the Hui APP, and there are up to 3,000 times high leverage. Do you dare to enter such a problem platform?

The above is the platform for the high leverage to sort out the problem of high leverage. In fact, there are many investors who like to play high leverage and feel that the return is high, but the editor still wakes you up.The problem platform involves high leverage, and I do n’t say much about Xiaobian. I still hope that everyone can choose to choose from.

✉ Notification:

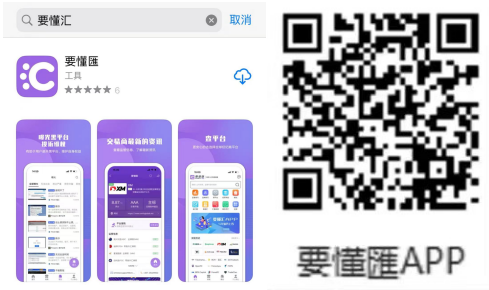

已 To understand that the current market has been launched, users can download the iOS version and Android version through the QR code sweeping noodles:

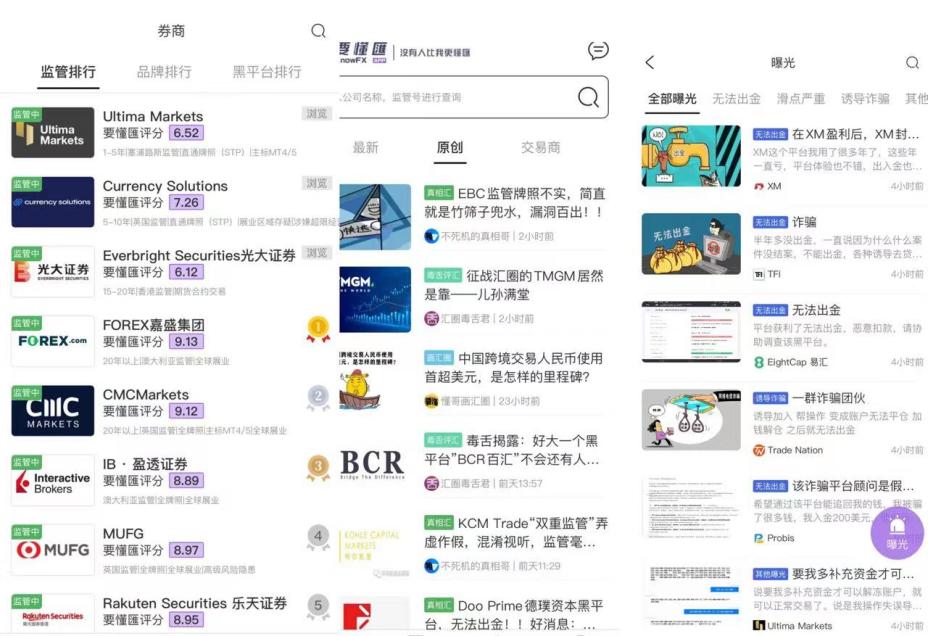

P By understanding the "Exposure" channel to understand the exchange app:

讯 More information such as brokerage information ranking and other information is to understand remittances:

提问:.ICMarkets的中文网站?要懂汇温馨提示:尊敬的用户...

关于德璞外汇对神探文章的侵权投诉,神探做出如下声明:内容侵犯名誉侵害...

提问:.OpenTrading平台的监管有吗要懂汇温馨提示:尊敬的...

金投行情漲幅排名最新查詢金融投行是指一種專門從事公司融資、併購、...

提问:.ELANATrading是合规的吗?要懂汇温馨提示:尊敬的...